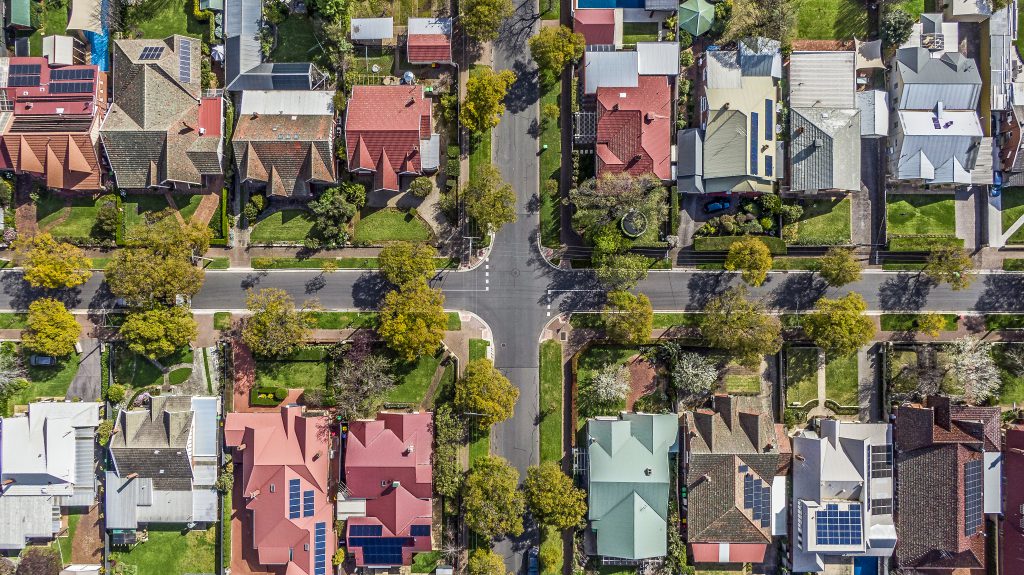

First signs investors are returning to market

Latest mortgage data from industry researcher PropTrack has revealed investors are returning to the real estate market. After having dropped to just a quarter of all mortgage applications, investors once again account for a third of all loans, PropTrack reported. The prospect of achieving record-high rents in cities and regional centres, coupled with lower property…

Read more