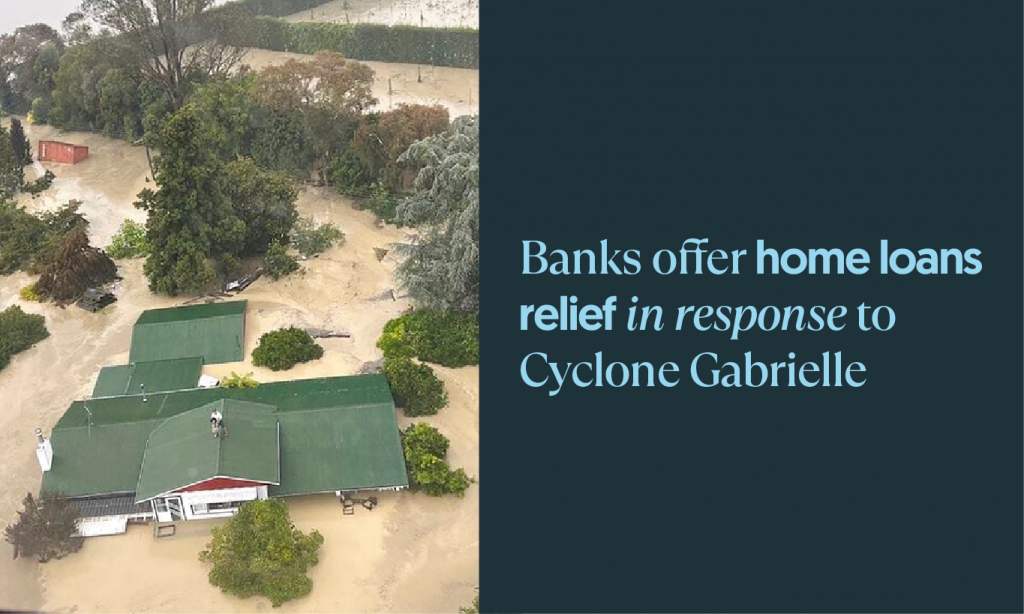

Banks offer home loans relief in response to Cyclone Gabrielle

For only the third time in the country’s history, a National State of Emergency was recently declared, to help in the response to Cyclone Gabrielle. The declaration applies to Northland, Auckland, Tairāwhiti, Bay of Plenty, Waikato and Hawke’s Bay CDEM Group areas, and the Tararua District. “A National State of Emergency gives the National Controller…

Read more