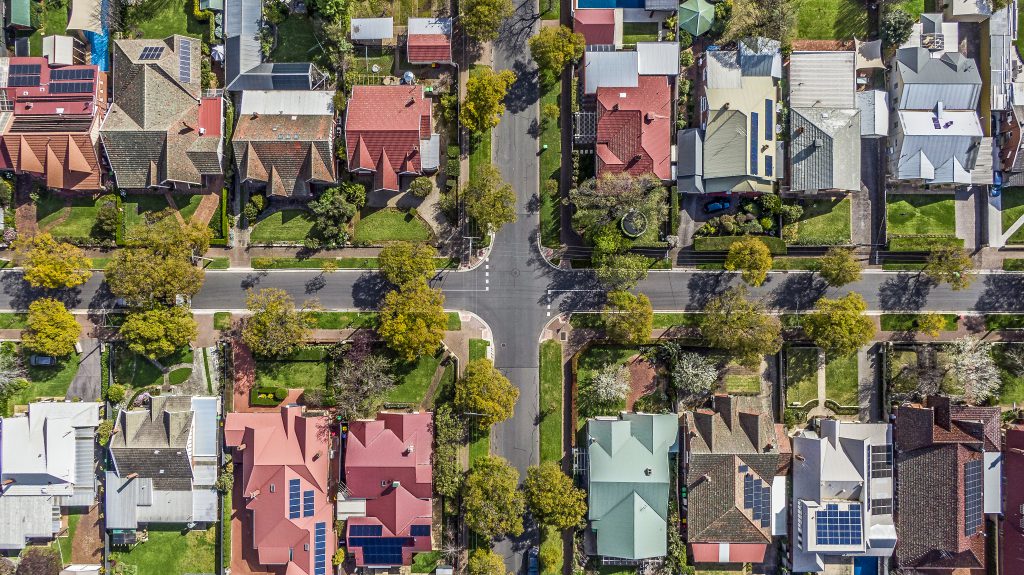

Rental shortages make now a good time to consider investing

Favourable conditions for property investors are again emerging as rents rise and higher interest rates start to take the heat out of the market. Weekly rents increased 4.7% in the 12 months to March. That’s the strongest growth in almost eight years, according to the latest REA Group’s PropTrack rental report. The low number of…

Read more