The golden rules of downsizing

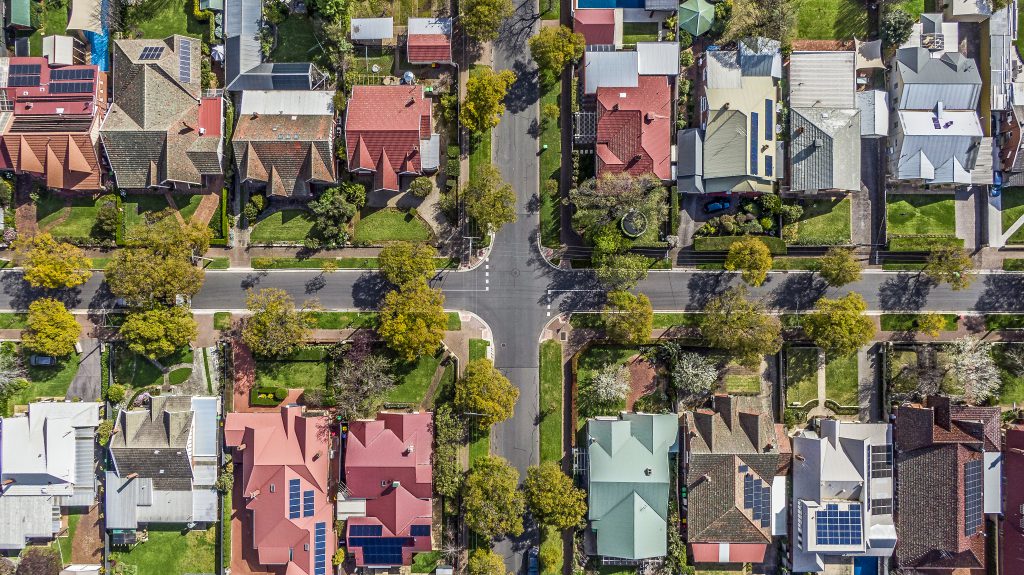

If you’re a parent with adult children who’ve successfully launched, statistics show you’re among the most likely demographic to contemplate whether you should downsize. As an experienced agency in our area, we have worked with many couples seeking to downsize in this area, maintaining an excellent lifestyle while reducing the obligations of owning a family…

Read more